Reuters BP said it had begun production at the Khazzan gas field in Oman, the sixth and largest of seven new upstream projects that are due to start for the British oil giant this year. Production at the field follows on from BP’s onshore compression and Juniper projects in Trinidad, West Nile Delta Phase 1 in Egypt, Persephone in Australia …

Read More »TimeLine Layout

September, 2017

-

26 September

Russia keeps spot as China’s top oil supplier

BEIJING / Reuters Russia beat Saudi Arabia to become China’s top crude oil supplier for a sixth month in August, as independent refiners ramped up purchases and as state-owned refiners bought seaborne shipments from the Russian Far East port of Kozmino. China’s crude oil imports from Russia in August were 4.426 million tonnes, or about 1.04 million barrels per day …

Read More » -

26 September

Oman chases bigger slice of oil trade with port project

Bloomberg Oman, the biggest Arab oil producer outside of OPEC, is turning up the heat in a regional battle for business from ships in need of fuel with a $600 million deal to build storage tanks at the port of Sohar. Sohar Port and Freezone signed a contract with Singapore-based trader Trescorp Alliance Pte to build an initial fuel-storage capacity …

Read More » -

26 September

‘Chinese Netflix’ to seek at least $8 billion value in IPO

Bloomberg Baidu Inc.’s iQiyi is targeting a US initial public offering as soon as in 2018 that could value China’s most popular Netflix-style streaming video service at more than $8 billion, two people familiar with the matter say. The company controlled by search giant Baidu is about to kick off negotiations with banks and deal arrangers and is shooting for …

Read More » -

26 September

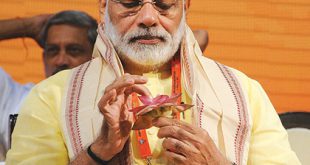

Modi’s $2.5bn plan to electrify villages

Bloomberg India’s Prime Minister Narendra Modi unveiled a 163.2 billion-rupees ($2.5 billion) programme to ensure electricity for all households. The programme will help poor people get electricity connections at no cost, Modi said in a speech in New Delhi on Monday, adding that his government is making efforts to provide power to about 3,000 unelectrified villages. The nation will aim …

Read More » -

26 September

India’s NMDC looks for major investor for first plant

Bloomberg India’s top iron ore miner NMDC Ltd. is looking to sell a stake of at least 49 percent in its Chhattisgarh steel plant, as it prepares to begin production at the 3-million-ton facility in three to six months, according to a company official. The state-run miner is seeking a partner for its first steel venture, which has been eight …

Read More » -

26 September

Alibaba to buy lossmaking Cainiao for $800 million

Bloomberg Alibaba Group Holding Ltd. will buy control of unprofitable delivery business Cainiao for 5.3 billion yuan ($800 million) and spend billions of dollars more to expand a shipping network that spans the world’s largest e-commerce market. China’s largest web marketplace agreed to increase its stake in Cainiao Smart Logistics Network Ltd. to 51 percent. Under the deal, Alibaba plans …

Read More » -

26 September

Jaguar Land Rover hunts for luxury brand

Bloomberg Jaguar Land Rover, the luxury unit of Tata Motors Ltd., is scouting for acquisitions of international automakers amid rising competition in the industry, people with knowledge of the matter said. The company has been holding internal discussions on buying other brands to diversify the range of vehicles it sells, the people said. It will consider purchases of luxury marques …

Read More » -

26 September

Hong Kong, Malaysia ‘look better,’ says ADB

Bloomberg Hong Kong and Malaysia are proving to be the biggest growth surprises in Asia. The two nations received the largest upgrades for this year among major economies in the Asian Development Bank’s latest outlook released on Tuesday. Meanwhile, India received the steepest downgrade. The global trade recovery is helping boost exports in Hong Kong and Malaysia while demonetisation and …

Read More » -

26 September

Nestle plans $10bn revamp as activist Loeb takes aim

Bloomberg Nestle SA may buy or sell businesses with combined sales of almost 10 billion francs ($10 billion) as Chief Executive Officer Mark Schneider embarks on the biggest overhaul of the world’s largest food company in at least a decade. Selective acquisitions and divestments could affect about 10 percent of total revenue, Schneider told investors as he unveiled his new …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.