Bloomberg Canon Inc. is finally entering the full-frame mirrorless camera market, joining Sony Corp. and Nikon Corp. in a new battleground for professional-grade camera equipment. The Japanese electronics giant will begin selling in late October the EOS R for 237,500 yen ($2,130), a price tag targeted at professionals and enthusiasts. It aims to move 20,000 units a month. Canon is …

Read More »TimeLine Layout

September, 2018

-

8 September

Lockheed’s $2 million drone race pits human versus machine

Bloomberg In a modern-day version of John Henry taking on a steam drill, Lockheed Martin Corp. is pitting human pilots against artificial intelligence in a $2 million drone race. The catch is that the computer-driven drones can’t be pre-programmed for the route or rely on human intervention. They must depend only on artificial intelligence and self-learning to navigate obstacle-filled racecourses …

Read More » -

8 September

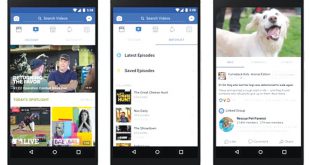

Facebook makes content deals for ‘watch’ product

Bloomberg Facebook Inc. is launching Watch, its video rival to YouTube, internationally and expanding the financial incentives that encourage people to share their content there. Video makers in five countries will be eligible to take a percentage of the ad revenue that comes from their content around the world as long as their videos on Watch are popular enough and …

Read More » -

8 September

Uber, Boeing enlisted to help Japan develop flying cars

Bloomberg Japan is making a push to develop flying cars, enlisting companies including Uber Technologies Inc. and Boeing Co. in a government-led group to bring airborne vehicles to the country in the next decade. The group will initially comprise 21 businesses and organizations, including Airbus SE, NEC Corp., a Toyota Motor Corp.-backed startup called Cartivator, ANA Holdings Inc., Japan Airlines …

Read More » -

8 September

Deutsche may have stalled Danske Bank’s Laundromat

Bloomberg Even while caught up in its own suspect transactions in Russia, Deutsche Bank AG may have helped curb the flow of illicit billions through Danske Bank A/S’s branch in Estonia. Deutsche Bank started rejecting individual dollar transactions going through Danske’s branch in Tallinn in 2014, and completely withdrew its services a year later, according to a person familiar with …

Read More » -

8 September

Citigroup to revamp investment banking with new leaders

Bloomberg Citigroup Inc. is planning to promote bankers Tyler Dickson and Manolo Falco to run a reconstructed version of its investment banking operations, people familiar with the plan said. The lender was expected to announce the plan on September 6 to combine its corporate and investment bank with its capital markets origination business, the people said, declining to be identified …

Read More » -

8 September

Commonwealth, ANZ Bank raise home rates as funding costs bite

Bloomberg Two more of Australia’s big banks have raised home loan rates as funding costs climb, heaping additional pressure on indebted households. Commonwealth Bank of Australia, the nation’s biggest mortgage lender, and Australia & New Zealand Banking (ANZ) Group Ltd. both raised their key standard variable mortgage rate, joining Westpac Banking Corp., which was the first of the big four …

Read More » -

8 September

Fintech firms need more scrutiny by regulators, says DBS chief Gupta

Bloomberg Regulators need to increase their scrutiny of non-bank firms that are moving into the financial business, according to the chief executive officer of DBS Group Holdings Ltd., Southeast Asia’s largest lender. “Absolutely,†Piyush Gupta said when asked at a Bloomberg forum in Singapore whether more regulation is needed for technology and other firms that are competing with traditional banks …

Read More » -

8 September

Stifel, latest lender to grow leveraged debt business

Bloomberg Stifel Financial Corp. is expanding its leveraged finance business as the firm seeks to grow in a hot corner of the credit markets. The St. Louis-based financial firm is building a new unit that will arrange and sell loans and bonds for junk-rated companies. It plans to use its own capital to underwrite deals, according to a statement seen …

Read More » -

8 September

Britain devises plan to keep jets flying in no-deal Brexit

Bloomberg Britain’s Civil Aviation Authority (CAA) is stepping up efforts to ensure that airlines and aerospace companies can carry on functioning in the event of a no-deal Brexit. The regulator has briefed government officials on its plans to recruit staff with the expertise to take over the certification of parts and planes should the split cause Britain to leave the …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.