Bloomberg American Airlines Group Inc closed a $5.48 billion loan with the US Treasury, increasing its pool of cash to help fund operations until travel demand begins to return. The credit facility, backed by American’s loyalty program, increased from an original $4.75 billion target after rivals such as Delta Air Lines Inc and Southwest Airlines opted out of the funds …

Read More »TimeLine Layout

September, 2020

-

28 September

Used-clothing platform Poshmark files for IPO

Bloomberg Poshmark Inc, an online resale marketplace for second-hand clothing, said it has filed confidentially for an initial public offering. The number of shares and the price range for the IPO haven’t been determined, Poshmark said in a statement. The Redwood City, California-based company had put off a potential IPO to focus on boosting sales and improving its execution, people …

Read More » -

28 September

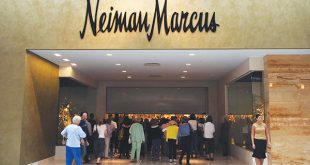

Neiman leaves bankruptcy with less debt to face turmoil

Bloomberg Neiman Marcus has officially come out of bankruptcy, a process that left the upscale department store with a lighter debt load and new owners to confront the same industry trends that led to its financial woes. The new Neiman Marcus Holding Company Inc emerged from Chapter 11 bankruptcy protection, saying it had eliminated more than $4 billion of existing …

Read More » -

28 September

Hawaiian Air touts drive-through tests

Bloomberg Hawaiian Airlines will offer customers drive-through coronavirus testing in California to help island-bound travellers avoid a 14-day quarantine rule —its answer to rival United Airlines’ new on-the-spot airport screenings. The competing testing plans would satisfy Hawaii’s requirement for visitors to show a negative test result within 72 hours of arrival in order to avoid its self-isolation rule, which has …

Read More » -

28 September

Danske scam reveals top-down culture that silenced bankers

Bloomberg The bank at the center of Europe’s worst ever money laundering scandal has yet to fully address the corporate culture issues that led it astray in the first place. That’s according to the watchdog that oversees Danske Bank. Denmark’s biggest bank spent years locked in a top-down hierarchy that left its management cut off from people further down the …

Read More » -

28 September

India’s central bank delays MPC meeting as posts lie vacant

Bloomberg The Reserve Bank of India rescheduled this week’s interest-rate meeting over the possible lack of a quorum in the Monetary Policy Committee (MPC). “The dates of the MPC’s meeting will be announced shortly,†the RBI said in a statement on Monday, without giving reasons for the delay. The meeting was scheduled to begin on Tuesday, with the rate decision …

Read More » -

28 September

Australia banks rise as lending laws eased to boost economy

Bloomberg Australia will make it easier for banks to approve mortgages and small-business loans to help the economy recover from its first recession in almost 30 years. Shares of the nation’s biggest lenders surged. As part of a sweeping overhaul of so-called responsible lending obligations, the government will allow banks to rely on income and spending information provided by borrowers …

Read More » -

28 September

Commerzbank names Deutsche’s Knof as CEO

Bloomberg Commerzbank passed over internal front-runners in favour of an executive with a reputation for tough cuts at its biggest rival to push through one of the largest restructuring programs in its history. Manfred Knof, 55, head of German retail banking at Deutsche Bank AG, takes over from Martin Zielke as Commerzbank chief executive officer on January 1, according to …

Read More » -

28 September

Singapore regulator, banks in talks to extend debt relief

Bloomberg Singapore’s central bank is in talks with lenders about extending the nation’s debt moratorium programme beyond December 31 to provide extra relief for borrowers hit by the fallout from the coronavirus pandemic. One of the key measures being discussed by the Monetary Authority of Singapore (MAS) and local banks is the possibility of lengthening the debt relief program, with …

Read More » -

28 September

Credit Suisse’s Pozsar warns of funding flood

Bloomberg The Federal Reserve is about to decide whether to extend a ban on banks buying back their own stock. It may shape up to be pivotal for year-end funding risks. If the Fed keeps its ban on buybacks in the decision due by end of September, banks will be stuck holding capital until next year and will “flood†the …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.