Admin

March 15, 2016 News

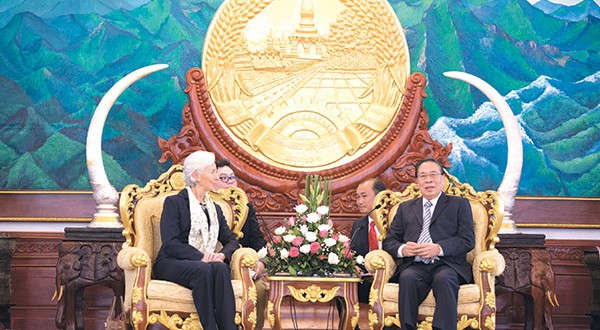

Bangkok / AFP Communist-ruled Laos must deepen reforms to maintain its rapid expansion, the IMF chief, Christine Lagarde said on Tuesday at the end of a rare visit to one of the world’s fastest growing economies. Resource-rich Laos has an annual growth rate of around 7.4 percent, but gains have not been evenly distributed and poverty remains widespread among its …

Read More »

Admin

March 15, 2016 News

New Delhi / Bloomberg India may shut two of its oldest reactors almost five decades after they went into operation as power tariffs aren’t keeping pace with maintenance costs, according to Sekhar Basu, secretary at the Department of Atomic Energy. The first two reactors at Tarapur, about 100 kilometers from Mumbai at India’s western coast, suffer frequent maintenance shutdowns that …

Read More »

Admin

March 15, 2016 News

Beijing / Bloomberg China plans to set up a commercial rocket-launch company in view of the market’s potential, the official Xinhua news agency reported. China Sanjiang Space Group Co. is preparing to enter the commercial-rocket business with a launch slated for 2017, Xinhua reported Tuesday, citing the company’s chief engineer Hu Shengyun. Some Internet companies have expressed interest in collaborating …

Read More »

Admin

March 15, 2016 News

Beijing / AP A Chinese company says it will resume construction work on a $1.5 billion port city project that was suspended for one year due to questions over environmental impact. CHEC Port City Colombo issued a statement Tuesday welcoming the Sri Lankan government’s decision to allow the project to resume. It said a supplementary environmental impact study was done …

Read More »

Admin

March 15, 2016 News

Manila / DPA The central banks of the Philippines and Malaysia have agreed to allow up to three so-called Qualified Asean Banks (QABs) from each country to operate in the other. In a statement, the Bangko Sentral ng Pilipinas (BSP) said Governor Amando M. Tetangco Jr. had signed a heads of agreement (HOA) with Bank Negara Malaysia (BNM) Governor Zeti …

Read More »

Admin

March 15, 2016 News

New Delhi / Bloomberg India’s technology services sector is hiring more women but females still assume just a fraction of senior roles, according to a joint study by the industry’s trade group and PricewaterhouseCoopers LLP. About 51 percent of entry-level jobs went to women in 2015, according to the report on an industry dominated by companies like Infosys Ltd. and …

Read More »

Admin

March 15, 2016 News

Sydney / AFP Australian logistics giant Asciano said on Tuesday it was recommending a $6.8 billion takeover deal between two rival local and international suitors, breaking up the company’s ports and rail assets. The announcement ended a bidding war for Asciano, a major Australian rail, freight and ports operator, between a consortium led by Canada’s Brookfield Infrastructure Group and a …

Read More »

Admin

March 15, 2016 News

Bloomberg Volkswagen AG was sued for €3.3 billion ($3.7 billion) over how the company informed markets about devices used to hide pollution in diesel engines, its biggest legal challenge in Germany to date after a wave of lawsuits in the U.S. on the scandal. The case was filed on Monday in Braunschweig on behalf of 278 institutional investors from around …

Read More »

Admin

March 15, 2016 News

Bloomberg The risks are stacking up for the pound. Britain’s currency fell the most in three weeks versus the dollar as investors braced for a budget at which fiscal tightening is anticipated, a Bank of England statement that they’ll peruse for indications about the interest-rate path and a Federal Reserve gathering where, speculation is building, officials will signal a boost …

Read More »

Admin

March 15, 2016 News

Bloomberg Iran may join other oil suppliers in freezing production after restoring its own output to levels before sanctions were imposed, Russian Energy Minister Alexander Novak said after meeting with the Persian Gulf nation’s oil minister. Iran has “reasonable arguments†not to be constrained by the freeze for now, Novak told reporters at the Russian embassy in Tehran. “Iran may …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.