Admin

May 29, 2016 Stocks

Bloomberg Some wheat traders are steering clear of Bangladesh’s tenders to import the grain after the nation rejected three cargoes earlier this year. The country’s Directorate General of Food received only two offers in a tender to buy 50,000 metric tons of wheat, Ilahi Dad Khan, director of procurement at the agency, said by phone from Dhaka. It had …

Read More »

Admin

May 29, 2016 Stocks

Bloomberg Gold looks very different than it did at the beginning of May. Along with platinum, palladium and silver, it is heading for the biggest monthly loss since November as investors anticipate higher borrowing costs in the U.S. Bullion has pared this year’s rally after retreating more than 5 percent in May as the dollar rallied and investors raised …

Read More »

Admin

May 29, 2016 Local News, Uncategorized

Abu Dhabi / Emirates Business Initial findings from The Emirate of Abu Dhabi Waste Master Plan 2040’s Waste Characterisation Study indicate that a significant amount of Municipal Solid Waste is food. Estimations of food waste range from 35% to roughly 50% in some waste collection areas in the Emirate. The fieldwork for the Waste Characterisation Study was carried out …

Read More »

Admin

May 29, 2016 Local News

Ritika Sharma / Emirates Business More and more Middle East residents are looking for tailor-made real estate assistance to make the process of searching, purchasing and selling properties in the region easy. Catering to this demand, many online portals are creating one-stop destinations to offer investors and residents bespoke real estate services. Talking about the trend that is becoming …

Read More »

Admin

May 29, 2016 Local News

Dubai / Emirates Business Mohammed Bin Rashid Al Maktoum Foundation (MBRF), a member of the Mohammed Bin Rashid Al Maktoum Global Initiatives, and the United Nations Development Programme (UNDP) organised Egyptian Knowledge and Innovation Society Conference in Cairo as part of a series of events in key international and regional cities to announce results of the Arab Knowledge Index. …

Read More »

Admin

May 29, 2016 Local News

Sunaina Rana / Emirates Business Leading UAE-based e-commerce website Souq.com has observed a significant 32% growth in smartphones sales in 2015. The Google Insights report stated that the UAE has witnessed the highest rate of device ownership in the world. The average consumer in the Emirates in 2015 owned three connected devices. Souq.com has been experiencing a 100% increase …

Read More »

Admin

May 29, 2016 Local News, Uncategorized

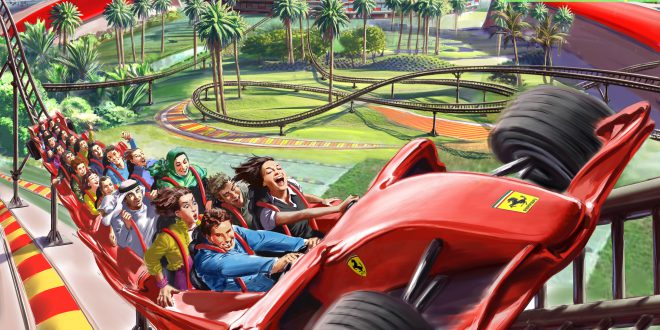

RITIKA SHARMA / Emirates Business UAE has always been atop the list of countries that are home to exciting theme parks and unmatchable thrill rides. The country is leading the way in growth of the theme-based entertainment industry, as Euromionitor report reveals that revenue from the sector is expected to reach US$837 million by 2019, with new parks on …

Read More »

Admin

May 29, 2016 Local News

ALKESH SHARMA / Emirates Business The GCC nations, led by UAE, are one of the biggest markets of smartphones globally. In a bid to beat the mounting competition and grab the maximum market share, mobile phone companies are adopting many innovative strategies, specially customised for this region. South Korean conglomerate Samsung has emerged as the clear-cut market leader in …

Read More »

Admin

May 29, 2016 Local News, Uncategorized

Abu Dhabi / Emirates Business A high-level delegation from the UAE Telecommunications Regulatory Authority (TRA) held discussions during its participation at the recently concluded 27th meeting of the GCC Committee for Undersecretaries of Post and Telecommunications, in Riyadh. Topics covered partnerships in the telecommunications sector especially the recommendations issued by the Secretariat General regarding Post Office Agents Association and …

Read More »

Admin

May 29, 2016 Local News

Dubai / Emirates Business Dubai’s government is a global leader in fostering a start-up approach to drive citizen happiness and the knowledge-based Digital Economy, government and smart technologies experts announced at a special majlis. Attending the majlis, held at the Murjaan Ballroom at the MadinatJumeirah Convention Centre under the theme of, “Citizens of the Future: Run Live, Run Happy,†…

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.