Admin

July 31, 2016 Regional News

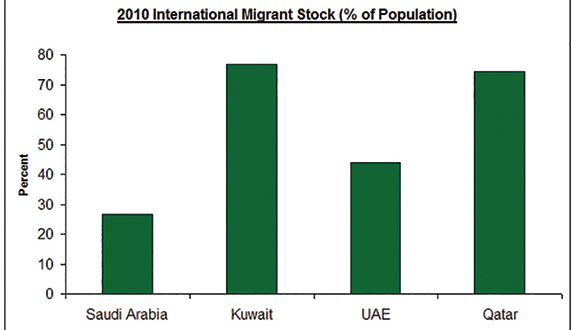

DUBAI / Emirates Business The latest Indosuez Wealth Management research report, ‘Macro Comment – MENA Update’, noted that the demography of the GCC region would play a crucial role in the economic growth and future of the region. “There are some interesting observations for the GCC region when we link demographics with financial markets. Replacing the investment horizon linked …

Read More »

Admin

July 31, 2016 Regional News

DUBAI / Emirates Business Investments in specialisation and preventative care may hold the key to improving both patient outcomes and hospital productivity, according to a London Business School expert. The findings come on the back of the recently announced Kuwait Development Plan (KDP) for 2015-2020, which outlines healthcare as a top government priority with sweeping reforms targeted at both …

Read More »

Admin

July 31, 2016 Regional News

DUBAI / Emirates Business More than 50,000 schools are expected to be set up throughout the Gulf region by 2020 as both public and private stakeholders seek to capitalise the growing education market throughout the region. Citing findings from the GCC Education Industry report published by Alpen Capital, organisers of the forthcoming International and Private Schools Education Forum (IPSEF) …

Read More »

Admin

July 31, 2016 Regional News

Bloomberg Tunisia is looking to form a new government after lawmakers fired the prime minister in the latest skirmish reflecting the struggle for political stability and economic growth in the birthplace of the Arab Spring. A total of 118 of 217 lawmakers voted late Saturday in favor of a no-confidence motion against Prime Minister Habib Essid. The vote sets …

Read More »

Admin

July 31, 2016 Regional News

Emirates Business Messe Frankfurt Middle East, one of the region’s largest exhibition organisers, is expanding its regional reach with the announcement of the inaugural Materials Handling Saudi Arabia 2016. The two-day conference and exhibition will take place from November 28-29 at the Park Hyatt Hotel in the port city of Jeddah, offering global suppliers and regional manufacturers direct access …

Read More »

Admin

July 31, 2016 Aviation

AP Warning about potential high-fatality accidents, safety investigators recommended two years ago that the Federal Aviation Administration impose greater oversight on commercial hot air balloon operators, government documents show. The FAA rejected those recommendations. A hot air balloon carrying at least 16 people crashed Saturday in Central Texas. Authorities say it’s unlikely anyone survived. In a letter to FAA …

Read More »

Admin

July 31, 2016 Aviation

Relaxnews It could be the end of an era for one of aviation’s most iconic airplanes, with Boeing hinting at the end of the production line for its double-decker 747 aircraft. Weak sales and encroaching competition are forcing the planemaker to re-evaluate the production of its legendary 747 aircraft, the original Jumbo Jet which changed the face of the …

Read More »

Admin

July 31, 2016 Aviation

Bloomberg German carrier Lufthansa has posted a seat on a plane as an Airbnb listing, in a new, interesting sales tactic aimed at filling seats. Posted under the heading, “Luxury Awaits Above the Clouds,†the listing is for a return flight from Frankfurt to New York in a premium economy seat for €699 ($775 USD). “Our cabin isn’t in …

Read More »

Admin

July 31, 2016 Aviation

The Diplomat On July 27, India’s Ministry of Defense signed a $1 billion deal with U.S. aircraft maker Boeing for the purchase of four additional Poseidon 8I Neptune advanced maritime patrol/anti-submarine warfare aircraft, according to Indian media reports. The contract was inked during an official visit to New Delhi by U.S. Under Secretary of Defense for Acquisition, Technology and …

Read More »

Admin

July 31, 2016 Real Estate

Johor Bahru / AFP A planned multi-billion-dollar new city near Singapore is attracting interest from investors with promises of luxury living but there are questions over its future owing to China’s economic woes and warnings of environmental catastrophe. Forest City, a $42 billion futuristic “eco-city†of high-rises and waterfront villas, will sit on four man-made islands on the Malaysian …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.