Admin

August 11, 2016 Local News

Dubai /Â WAM A delegation from the Roads and Transport Authority (RTA) recently visited the Dutch capital Amsterdam, and the German city Stuttgart to get familiarised with the experience of the two cities in smart mobility and autonomous driving. The move is part of the smart mobility strategy aimed at converting 25 percent of total mobility journeys in Dubai into self-driving …

Read More »

Admin

August 11, 2016 Local News

Dubai / WAM The Dubai Health Authority (DHA) discussed on Thursday ways of stroke prevention during its smart clinic. Dr. Suhail Al Rukn, stroke and neurology Consultant and head of stroke unit at Rashid Hospital, said: “ Stroke awareness in the UAE is particularly important. Fifty per cent of the stroke patients in the UAE are below the age of …

Read More »

Admin

August 11, 2016 Banking

Bloomberg The European Central Bank may need to rely more on asset purchases for monetary stimulus as its negative interest rates approach the limit of their effectiveness, economists at the International Monetary Fund (IMF) said. While negative rates in the euro area have successfully eased financial conditions for banks and their customers — spurring a modest credit expansion that supports …

Read More »

Admin

August 11, 2016 Banking

Bloomberg New Zealand’s dollar surged to the highest level since May 2015 after traders deemed the central bank’s decision to cut borrowing costs was insufficiently dovish amid the global ardor for yield that’s been spurred by unprecedented global monetary easing. The Aussie and kiwi dollars have gained at least 0.5 percent this month as their central banks reduced benchmark …

Read More »

Admin

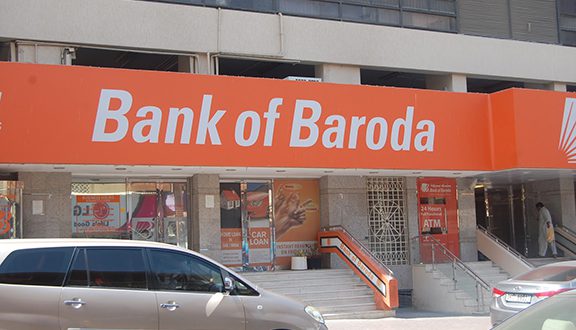

August 11, 2016 Banking

Mumbai / Bloomberg Bank of Baroda, India’s second largest state-run lender by assets, fell the most in almost three months after surging bad-loan provisions dragged first-quarter profit lower. Shares of Baroda fell 8.3 percent, the biggest intraday drop since May 16, to 147.15 rupees as of 12:20 p.m. local time. The stock has lost 6 percent this year, compared …

Read More »

Admin

August 11, 2016 Banking

Bloomberg South Korea’s central bank held its key interest rate at a record low as board members deferred further policy action until they have a clearer picture of the economy’s path. The decision to keep the seven-day repurchase rate at 1.25 percent was forecast by all 19 economists surveyed by Bloomberg. All seven board members agreed on the decision, …

Read More »

Admin

August 11, 2016 Banking

Bloomberg Turkey’s banks are taking their orders from the top. At least seven lenders in the country announced they’d slashed interest charges on mortgage loans after President Recep Tayyip Erdogan said resistance to lower borrowing costs could be ” treason.” The remarks were the harshest yet from Erdogan, who’s been pushing the nation’s central bank for several years to …

Read More »

Admin

August 11, 2016 Opinion

Regulatory reform was a big part of Donald Trump’s major economic address yesterday, which offered three proposals to reduce excessive regulation. The problem is serious. The proposals aren’t. First, Trump calls for a temporary moratorium on all federal regulations. For starters, that would be unlawful. Congress has required executive agencies to issue regulations involving air pollution, food safety, consumer …

Read More »

Admin

August 11, 2016 Opinion

Chris Bryant When Eon said almost two years ago it would split in two — separating its traditional business of generating power into a new company, to leave it with renewables and electricity grids — the embattled German utility seemed on the cusp of fresh start. The 3 billion-euro ($3.4 billion) first-half net loss Eon posted on Wednesday shows …

Read More »

Admin

August 11, 2016 Local News, Uncategorized

Dubai / Emirates Business Dubai Parks and Resorts announced on Thursday that the region’s largest theme park destination will open its gates to the public on October 31. This unique destination will be comprised of three theme parks – Bollywood Parksâ„¢ Dubai, MOTIONGATEâ„¢ Dubai, and LEGOLAND® Dubai, together with LEGOLAND® Water Park. The destination will also include Riverlandâ„¢ Dubai, …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.