Admin

August 17, 2016 Energy

Reuters Iran’s new oil and gas contracts will need amendments, its oil minister said after a meeting with the speaker of parliament, adding that the new contracts will not be sent to the assembly for final approval. The launch of the Iran Petroleum Contract (IPC) has been postponed several times as hardline rivals of pragmatist President Hassan Rouhani resisted …

Read More »

Admin

August 17, 2016 Regional News

Reuters An offer of 3 billion riyals ($825 million) of Qatar government bonds, the first domestic government bond offer this year, was successful and showed liquidity in the Qatari banking system is healthy, a central bank official told Reuters on Tuesday. “It was a very successful auction with big demand. It shows liquidity is fine. The demand was fine …

Read More »

Admin

August 17, 2016 Regional News

Reuters Telecommunications operator Zain Saudi Arabia said on Tuesday it would save 175 million riyals ($46.7 million) by using a Chinese bank to refinance a 2.25 billion riyal loan that it had secured just two months ago. The new, $600 million loan was signed with Industrial and Commercial Bank of China; it has a two-year maturity with an option …

Read More »

Admin

August 17, 2016 Regional News

Bloomberg Libya’s government appointed a steering committee to head the country’s $60 billion sovereign wealth fund, where rifts have hindered efforts to unite financial institutions in the fractured North African oil exporter. The Libyan Investment Authority’s temporary five-member committee will be headed by one of the fund’s former directors, Ali Mohamed Hassan, according to a statement issued by the …

Read More »

Admin

August 17, 2016 Regional News

Bloomberg Israel’s faltering industry of tech startups is facing another hurdle amid mounting questions regarding government commitments to funding young companies. A senior official in the technology industry said the chief scientist’s office didn’t receive a 240-million-shekel ($63.5 million) round of additional funding to finish the year as had occurred in the past. Without this sum, which is 15 …

Read More »

Admin

August 17, 2016 Regional News

Bloomberg The rally in Qatar’s stock market may have been too strong for its own good. The QE Index’s world-beating 2.2 percent advance left it about 7 percent above the average of analysts’ price targets, the most among more than 70 gauges tracked by Bloomberg. The measure’s 14-day relative strength index was at 79 points, above the level of …

Read More »

Admin

August 17, 2016 International News, Uncategorized

Bloomberg Britain’s labor market isn’t cracking under the weight of Brexit yet. Companies added 172,000 jobs in the second quarter and the unemployment rate held at 4.9 percent, showing resilience in the buildup to the June 23 referendum when the UK decided to quit the European Union. While the data available for July—after the vote—are more volatile, they show …

Read More »

Admin

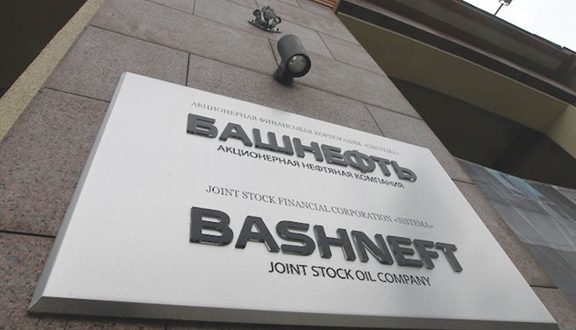

August 17, 2016 International News

Moscow / AFP The Russian government has unexpectedly halted the sale of its stake in oil producer Bashneft planned as part of a privatisation drive to shore up dwindling financial reserves, reports said Wednesday. The decision to postpone the sale indefinitely, reportedly taken by Prime Minister Dmitry Medvedev and agreed with President Vladimir Putin, came after the economy ministry …

Read More »

Admin

August 17, 2016 International News, Uncategorized

Bloomberg Poland’s law restricting the proximity of turbines near homes is bringing the wind-energy industry to a standstill, according to environmental researchers. At stake are more than 500 million zloty ($131.4 million) spent by investors to date on developing wind projects, according to a survey published on the website of Ambiens sp. z o.o. Environmental consultants last month polled …

Read More »

Admin

August 17, 2016 International News

Portugal / Bloomberg Portugal’s government bonds fell for a second day amid speculation that ratings company DBRS Ltd. may downgrade the nation’s sovereign debt. The country’s 10-year bond yield rose to the highest in more than two weeks. DBRS’s rating of BBB (low) leaves it the only major company to rank Portugal’s debt as investment grade. That’s essential for …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.