Admin

September 18, 2017 International News, Uncategorized

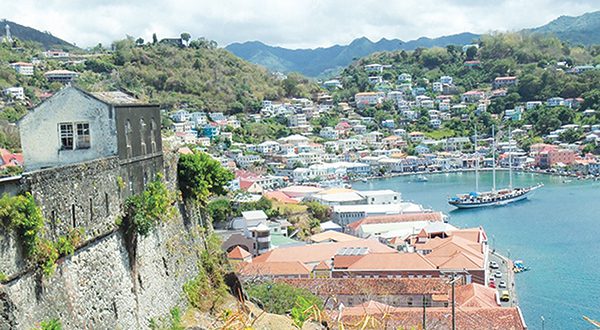

Bloomberg For the third time this month, a hurricane is spinning towards the already battered Caribbean and gathering strength along the way. The National Hurricane Center (NHC) upgraded tropical storm Maria to a hurricane as winds picked up to 150 kilometres per hour by Monday morning. The storm, 100 miles east of Martinique, is intensifying, and hurricane warnings have been …

Read More »

Admin

September 18, 2017 International News

Bloomberg Slack Technologies Inc. closed a $250 million funding round led by SoftBank Group Corp.’s Vision Fund, giving it more ammunition for expansion in an increasingly competitive market for workplace messaging services. The financing round values the startup at $5.1 billion, up from $3.8 billion the last time. The Vision Fund is joined by Accel and other investors, Slack said. …

Read More »

Admin

September 18, 2017 International News

Bloomberg London’s black cabs going electric shows the new wave of automobile technology is already reshaping the metals industry. After being closed for three years due to a weak market, Sapa SA’s aluminum plant in south Wales will reopen this week to supply lightweight parts for automakers such as London Electric Vehicle Co., the maker of black cabs. It’s part …

Read More »

Admin

September 18, 2017 International News, Uncategorized

Bloomberg Ford Motor Co. gave its lagging Indian operations a boost by reuniting with local SUV maker Mahindra & Mahindra Ltd. to explore electric cars and new technologies, as the US automaker tries to gain a foothold in a country that’s set to become the world’s third-biggest car market. Ford and Mahindra formed a partnership for three years, aiming to …

Read More »

Admin

September 18, 2017 International News, Uncategorized

Bloomberg For two decades Steve Davis has made it his life’s work to save the Florida Everglades. Davis, a wetland ecologist with the Everglades Foundation, has been part of a push to restore millions of acres of marsh grasses and mangroves to their natural state. The effort, comprised nearly six-dozen projects carrying an estimated price tag of $16 billion, is …

Read More »

Admin

September 18, 2017 Politics, Uncategorized

Bloomberg President Donald Trump, who derided the United Nations as a “club for people to get together, talk and have a good time†after his election, is surprising veterans of the global body by leaning on it to help carry out his foreign policy agenda. From pushing the Security Council to tighten sanctions on North Korea to forging a partnership …

Read More »

Admin

September 18, 2017 Politics

Bloomberg A weakened Hurricane Jose could graze the Northeast as Hurricane Maria tears through the Caribbean, gaining strength and possibly heading toward the US in a week. Jose will probably be downgraded to a tropical storm as it comes close to Massachusetts on Wednesday—threatening shipping and real estate along the East Coast—before veering farther out into the Atlantic, the US …

Read More »

Admin

September 18, 2017 Politics

Bloomberg Europe and China are stepping up their coordination in the battle against global warming, a top EU official said, as the US mulls re-engaging in a landmark Paris agreement to cut greenhouse gases. The 28-nation European Union will press ahead with efforts to protect the environment by shifting to a low-carbon economy and reducing dependency on fossil fuels, said …

Read More »

Admin

September 18, 2017 Politics

Bloomberg Foreign Secretary Boris Johnson is again the focus in British politics after his challenge of Prime Minister Theresa May sparked a round of speculation over whether he’s willing to resign if she softens her stance on the Brexit bill or if he could be fired for insubordination. Both May and her top diplomat will be New York this week …

Read More »

Admin

September 18, 2017 Politics

Bloomberg Emmanuel Macron is aiming to show France can still punch its weight. After North Korea tested a nuclear weapon this month, the French President took time out of a state visit to Greece to lobby China’s Xi Jinping on ratcheting up sanctions. He’d already spoken to the leaders of Germany, the UK and Italy on the issue and in …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.