Admin

June 27, 2018 Retail

Bloomberg Conagra Brands Inc. agreed to buy Pinnacle Foods Inc. for about $8.1 billion in cash and stock, gaining freezer-aisle brands such as Birds Eye to capitalise on growing demand for frozen foods. The deal values Pinnacle at $68 a share, the companies said in a statement. The price is 23 percent above Pinnacle’s closing level on April 19, when …

Read More »

Admin

June 27, 2018 Aviation

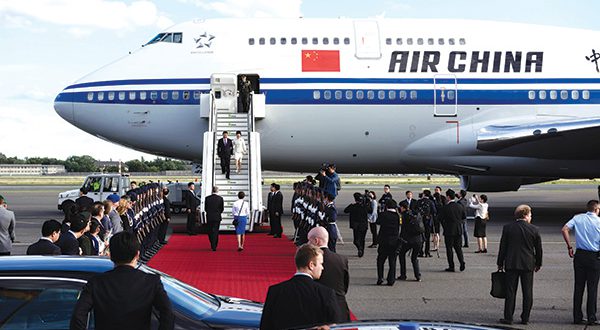

Bloomberg Chinese airlines ordered more than $100 billion of planes from Airbus SE and Boeing Co. in the past decade. Paying those bills is getting harder with the prospect of a trade war pushing the local currency to its lowest level in six months. A weaker yuan means Air China Ltd., China Southern Airlines Co. and China Eastern Airlines Corp. …

Read More »

Admin

June 27, 2018 Aviation

Bloomberg Air Tanzania Co. Ltd. will fly to Mumbai three times a week starting in September, it’s first flight outside the continent, after taking delivery of a Boeing 787-800 Dreamliner next month, the Dar es Salaam-based Daily News newspaper reported, citing Commercial and Business Development Director Patrick Ndekana. Tanzania is revamping its erstwhile struggling national carrier after investing in new …

Read More »

Admin

June 27, 2018 Retail

Bloomberg Steinhoff Africa Retail Ltd. shares fell after Tekkie Town head Bernard Mostert quit alongside fellow senior managers following a legal claim lodged against the retailer by the shoe chain’s founding shareholders. STAR, as Steinhoff Africa is known, has repeatedly said it shouldn’t be held liable for the claim by Tekkie Town founders led by Braam van Huyssteen, which relates …

Read More »

Admin

June 27, 2018 Real Estate

Bloomberg Hedge funds run by Christopher Hohn and Dinakar Singh accused one of India’s largest real estate developers of defrauding its foreign investors of at least $1.5 billion. “If we do nothing, we will largely bleed dry and get nothing back,†Singh, who heads Axon Capital, said at a gathering in New York of investors in a fund started by …

Read More »

Admin

June 27, 2018 Real Estate

Bloomberg UK house-price growth has slowed to the weakest pace in five years, while London values are falling, according to Nationwide Building Society. The lender said the “subdued economic activity†and squeezed household budgets are keeping a lid on demand, and the national market is unlikely to see any change to the recent trend in the near term. Nationwide’s monthly …

Read More »

Admin

June 27, 2018 Banking

Bloomberg German banks — jostling for position in one of Europe’s most competitive markets — will plow billions of euros into digitisation over coming years to boost revenue. The question is how many will get their money back. The 50 top lenders will spend as much as 6 billion euros ($7 billion) by 2020 developing their digital initiatives, according to …

Read More »

Admin

June 27, 2018 Banking

Bloomberg China’s latest monetary policy move, due to take effect on July 5, won’t do much for investors seeking respite from a falling stock market or slumping yuan. 500 billion yuan ($75.7 billion) out of 700 billion yuan freed up by a cut in reserve-ratios announced June 24 is intended to assist banks in funding debt-to-equity swaps — a key …

Read More »

Admin

June 27, 2018 Banking

Bloomberg Bank of America Corp. was accused in a lawsuit of providing more than 100 accounts used to perpetrate what the US regulators called a $102 million Ponzi scheme. The class-action suit filed on behalf of people who lost money follows a complaint last week by the Securities and Exchange Commission alleging that five men and three companies defrauded more …

Read More »

Admin

June 27, 2018 Banking

Bloomberg The Bank of England (BOE) stepped up pressure on the European Union to remove threat that Brexit poses to trillions of pounds of derivative contracts. Unless the EU follows the UK government in putting in place temporary workarounds, there could be havoc in financial markets when Britain leaves the bloc next March. Firms could find themselves unable to service trillions …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.