Admin

April 8, 2019 Stocks

Bloomberg Pound traders appear undaunted by the lack of Brexit clarity even with just days left for Britain to officially leave the European Union. The UK currency was up on Monday and a gauge of expected short-term sterling volatility is near a two-week low, showing there’s little panic even as the April 12 exit date draws closer. Investors are increasingly …

Read More »

Admin

April 8, 2019 Banking

Bloomberg With his call for lower interest rates, President Donald Trump has weighed into a debate inside the Federal Reserve about what central bankers should do about sub-par inflation. It’s not totally crazy to think he’ll eventually carry the day. In advocating easier credit, Trump and senior economic adviser Larry Kudlow have harped on the paucity of inflation to justify …

Read More »

Admin

April 8, 2019 Banking

Bloomberg Slowing global growth could threaten central bank independence and bring calls to expand remits beyond inflation targeting, according to Fitch Ratings. “Investors would be wise to consider the potential implications of mounting political pressures for greater contributions from monetary policy to support economic growth, possibly by unconventional means,†said James McCormack, Global Head of Sovereign Ratings at Fitch. Central …

Read More »

Admin

April 8, 2019 Banking

Bloomberg Japan’s central bank further fueled the growing consensus that the economy has made a turn for the worse with its widest downgrade of the nation’s regional economies in six years. In its equivalent to the Fed’s Beige Book, the Bank of Japan (BOJ) marked down its economic assessment of three out of nine regions in its quarterly report released …

Read More »

Admin

April 8, 2019 Banking

Bloomberg A UniCredit SpA employee in China allegedly siphoned off about 100 million yuan ($15 million) of clients’ money over three years by taking advantage of shared passwords and other internal security loopholes, according to people familiar with the matter. Local police and the China Banking and Insurance Regulatory Commission were informed late last year, and the regulator will levy …

Read More »

Admin

April 8, 2019 Banking

Bloomberg Some of the world’s largest lenders, law firms and real estate companies are turning to the technology behind Bitcoin to streamline the process of buying and selling property. Barclays Plc, Royal Bank of Scotland Group Plc and Clifford Chance LLP were among 40 firms to test new platform developed by Instant Property Network, a company backed by blockchain software …

Read More »

Admin

April 8, 2019 Banking

Bloomberg Economists gathered at an epicenter of Europe’s slowdown said there’s increasing urgency for political action to foster growth and shift the burden from the region’s monetary officials. At a meeting by Lake Como in Northern Italy, there was an outpouring of sympathy for European Central Bank President Mario Draghi and the onus his institution has faced to deliver incessant …

Read More »

Admin

April 8, 2019 Aviation

Bloomberg Jet Airways India Ltd’s lenders invited initial bids to buy as much as 75 percent of the debt-laden carrier, starting a process that will determine the future of India’s oldest surviving private airline. Potential buyers must submit their interest by April 10, State Bank of India Ltd, the lead creditor, said in a document. A strategic bidder should have …

Read More »

Admin

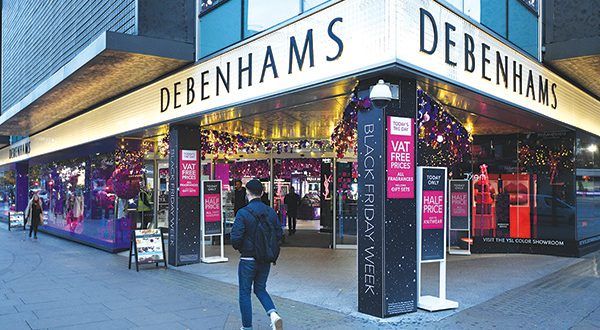

April 8, 2019 Retail

Bloomberg Billionaire Mike Ashley made a fresh bid to prevent a wipeout of his equity in Debenhams Plc, offering to underwrite the issuance of 150 million pounds ($196 million) in new shares. The chief executive officer of Sports Direct International Plc said his support for the shareholder rights issue is conditional on him being named CEO of the department-store chain, …

Read More »

Admin

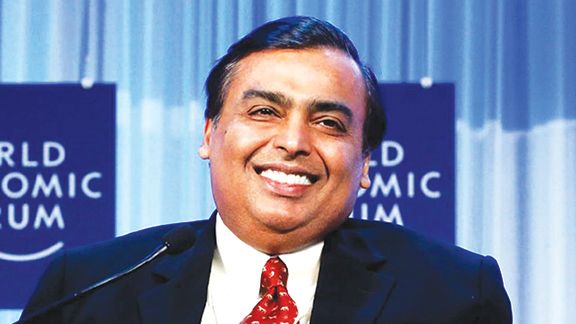

April 8, 2019 Retail

Bloomberg A $2.5 billion spending spree involving more than two dozen deals provides some insight into how Mukesh Ambani is piecing together a strategy to take on Amazon.com in India. Asia’s richest man is sharpening his focus on e-commerce with a string of tiny acquisitions and stake purchases to face the world’s largest online retailer, after shaking up India’s telecommunications …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.