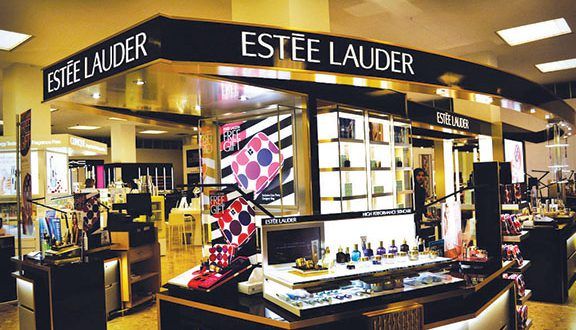

Bloomberg Estee Lauder Cos agreed to buy the two-thirds of Have & Be Co, the South Korean owner of Dr. Jart+ cosmetics, that it didn’t already own for about $1.1 billion, its first acquisition of an Asian beauty brand. Founded in 2005 in Seoul, Dr. Jart+ sells moisturisers, masks, cleansers and serums under names like Cicapair and Ceramidin and will …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.