Admin

February 11, 2022 Aviation

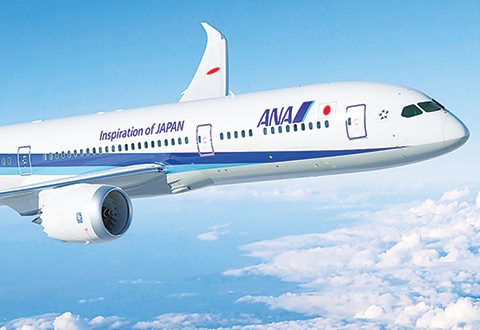

Bloomberg The head of Japan’s biggest airline has urged the government to ease its strict border controls, which have effectively shut the nation to foreigners, saying they are hurting the economy and the aviation industry. “There are various problems happening with the situation that foreigners can’t enter Japan,†Yuji Hirako, the president of All Nippon Airways Co. said in …

Read More »

Admin

February 11, 2022 Retail

Bloomberg The union organizing Starbucks Corp. employees filed a federal complaint accusing it of illegally firing activist employees, marking a new and more contentious chapter in the efforts to expand labor representation among the company’s workers. In a filing with the National Labor Relations Board, the union, Workers United, said Starbucks violated federal law by firing seven employees at …

Read More »

Admin

February 11, 2022 Aviation

Bloomberg Akasa, a new Indian airline backed by billionaire Rakesh Jhunjhunwala, plans to offer stock options to attract staff, using a lure more often deployed by technology startups in its bid to gain a foothold in one of the world’s most competitive air-travel markets. The carrier, which is preparing to start flying in late May, is taking the unusual …

Read More »

Admin

February 11, 2022 Retail

Bloomberg Dunelm Group Plc, a UK home-furnishings company, is raising prices to protect profits from higher shipping and raw-material costs, adding to the string of bad inflation news for British shoppers. Consumers are already bracing for faster inflation after the Bank of England warned that it could top 7% this year. Tesco Plc Chairman John Allan said this week …

Read More »

Admin

February 11, 2022 Banking

Bloomberg Australia concluded its quantitative easing (QE) program, leaving the Reserve Bank with more than 40% of government bonds on issue and raising questions about what it will do with the pile of assets. The RBA on Thursday conducted its final A$1.6 billion purchase of securities under a program that tripled its balance sheet to about A$650 billion ($465 …

Read More »

Admin

February 11, 2022 Banking

Bloomberg ABN Amro Bank NV said it will start a 500 million-euro share buyback ($571 million) after fourth quarter profit jumped, joining European peers in pledging higher returns as the industry rebounds from the pandemic. Net income soared to 552 million euros in the period, exceeding the 426 million euros that analysts surveyed by Bloomberg had expected on average, …

Read More »

Admin

February 11, 2022 Banking

Bloomberg Societe Generale SA rebounded with a record annual profit from its first losing year in decades, as all main businesses at the French lender beat analysts’ estimates in the fourth quarter. A resurgent equities trading unit and record earnings from financing and advisory were among the highlights as revenue jumped 13% in the final months of last year …

Read More »

Admin

February 11, 2022 Banking

Bloomberg US credit-card bills jumped sharply last quarter as Americans returned to pre-pandemic spending habits. Credit-card balances increased every quarter in 2021 to end the year at $856 billion, the Federal Reserve Bank of New York said. The fourth-quarter gain was the largest in figures dating back 22 years, and while the total amount is still below pre-Covid levels, …

Read More »

Admin

February 11, 2022 Banking

Bloomberg Zambia’s central bank expects to complete research on forming a digital currency that could cut transaction costs and boost participation in the formal financial system by the fourth quarter. “The results of research will form part of the input in the policy considerations on whether to introduce a central bank digital currency in Zambia,†Nkatya Kabwe, acting assistant …

Read More »

Admin

February 11, 2022 Banking

Bloomberg Credit Suisse Group AG warned that higher costs for pay and its restructuring will weigh on results in 2022, adding to the bank’s woes after it posted the biggest quarterly loss in about four years. The Zurich-based bank had a net loss of about 2 billion francs ($2.16 billion) in the three months through December, primarily driven by …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.