SHARJAH/WAM His Highness Sheikh Dr. Sultan bin Mohammed Al Qasimi, Supreme Council Member and Ruler …

Read More »-

Sharjah Ruler issues Decree attaching Al Muntada Al Islami to Department of Islamic Affairs

-

Saud bin Saqr attends dinner banquet hosted by Costa Rica, El Salvador, Guatemala embassies

-

DLD launches Phase II of Real Estate Tokenisation Project

-

G42, Vietnamese consortium to build national AI infrastructure

-

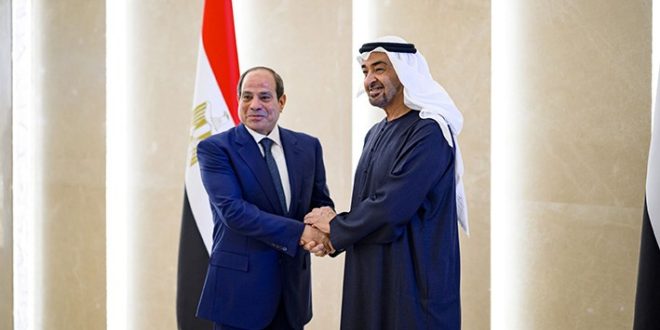

UAE President receives Egyptian President on arrival in Abu Dhabi

-

Sharjah Ruler issues Decree attaching Al Muntada Al Islami to Department of Islamic Affairs

SHARJAH/WAM His Highness Sheikh Dr. Sultan bin Mohammed Al Qasimi, Supreme Council Member and Ruler …

Read More » -

Saud bin Saqr attends dinner banquet hosted by Costa Rica, El Salvador, Guatemala embassies

-

DLD launches Phase II of Real Estate Tokenisation Project

-

G42, Vietnamese consortium to build national AI infrastructure

-

UAE President receives Egyptian President on arrival in Abu Dhabi

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.