In response to the lifestyle of hijabi women in the Middle East, and with …

Read More »-

Glowmode Highlights the New Modest Activewear Collection 2026 in Dubai

In response to the lifestyle of hijabi women in the Middle East, and with …

Read More » -

ADNIC profits reach AED479.9m in 2025

-

Mansour bin Zayed chairs Mubadala Investment Company board meeting, approves 2026 plan

-

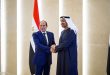

UAE President receives Mohammed bin Rashid

-

EMSTEEL revenues reach AED8.9 billion in 2025

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.