SHARJAH/WAM His Highness Sheikh Dr. Sultan bin Mohammed Al Qasimi, Supreme Council Member and Ruler …

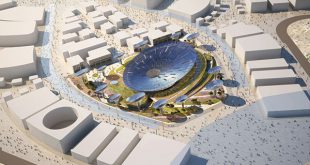

Read More »Expo 2020 Dubai to unveil ‘greener world strategy’

Dubai / WAM Expo 2020 Dubai will unveil details about its strategy for a cleaner, greener world and its centrepiece Sustainability Pavilion at the forthcoming Abu Dhabi Sustainability Week (ADSW). The fifth annual ADSW, running from January 12-21, also hosts the World Future Energy Summit, and will focus on identifying and discussing solutions to the world’s energy and sustainability …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.