Bloomberg The pound rallied and UK bonds surged as more of Prime Minister Liz Truss’s package of unfunded tax cuts were reversed. Stocks rise, with investors preparing for a number of key earnings reports this week. Chancellor Jeremy Hunt said the UK will raise £32 billion ($36.15 billion) with new measures, scrapping plans to cut income tax and dropping a …

Read More »Stocks

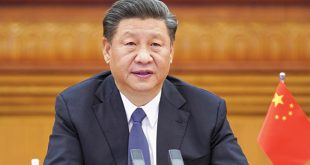

China seeks to boost stock market as Xi speech disappoints

Bloomberg Chinese regulators are ramping up efforts to support the stock market, which saw little reprieve from President Xi Jinping’s speech amid continued pressure from geopolitical tensions and the Covid Zero policy. A series of market-supporting measures are in the pipeline, including proposals to encourage companies to buy back shares and to ease curbs on short-term transactions by overseas …

Read More »UK bonds head for biggest weekly rally in a decade on U-turn bets

Bloomberg UK bonds surged to head for their biggest weekly rally in a decade on mounting expectations the government is preparing an imminent retreat from plans for vast unfunded tax cuts. The rally came at the end of another tumultuous week for markets, with both bonds and the pound yo-yoing on changing sentiment. UK Prime Minister Liz Truss is …

Read More »Private bets shielding world’s largest investors from market mayhem

Bloomberg A shift towards private markets is cushioning many of the world’s largest investors from the wreckage wrought by runaway inflation and spiralling interest rates. The big question now looming over giants from China’s $1.2 trillion sovereign wealth fund to California’s public pension, the largest in the US, is how long those private bets will remain insulated as the economic …

Read More »TSMC cuts capital spending by 10% in a warning for tech sector

Bloomberg Taiwan Semiconductor Manufacturing Co (TSMC) slashed its 2022 capital spending target by roughly 10%, a dramatic sign of trouble for the technology industry from the world’s most valuable chip company. TSMC said it expects to spend about $36 billion in 2022 on capital equipment, down from at least $40 billion previously. The sharp reduction in expenditure — an important …

Read More »Equities rise, with eyes on US inflation data

Bloomberg US equity index futures rise on Thursday, ahead of key US inflation data that could determine how much further the Federal Reserve’s policy-tightening cycle will run. Futures contracts on the S&P 500 were up 0.5% as of 5:55 am in New York, while those on the Nasdaq 100 gained 0.3%. The benchmark index had tumbled to its lowest …

Read More »UK bonds tumble as confusion reigns over nation’s policies

Bloomberg UK bonds tumbled while the pound rose as investors digested a deeply uncertain policy outlook from both the Bank of England (BOE) and Liz Truss’s government. The yield on 30-year gilts — favoured by the pension funds at the heart of recent market stress — rose as much as 22 basis points to 5.02% after a BOE spokesperson …

Read More »ByteDance offering to buy back employees’ shares for $155 apiece

Bloomberg ByteDance Ltd. is offering to buy back shares from its employees, ramping up efforts to boost staff morale after plans for an initial public offering stalled. The Beijing-based company, parent of the hit TikTok video app, informed employees on Wednesday that it will repurchase shares at a price of $155 per restricted stock unit to help those who …

Read More »Chipmaker rout engulfs TSMC, Samsung with $240b wiped out

Bloomberg Asia’s top chip stocks tumbled on Tuesday, ensnared in an escalating US-China tech race that has erased more than $240 billion from the sector’s global market value. Taiwan Semiconductor Manufacturing Co (TSMC), the world’s largest contract chipmaker, plunged a record 8.3% while Samsung Electronics Co. and Tokyo Electron Ltd. also declined. The selloff spread to the foreign-exchange market …

Read More »Currencies replace crypto at forefront of market trading chaos

Bloomberg The atmosphere at a conference of currency market professionals was markedly different from the previous few years: there was a buzz. Senior executives from banks and brokers were feeling optimistic about the prospects of foreign-exchange trading at the recent gathering in Amsterdam. They’ve spent years eyeing the world of crypto with envy, as digital assets thrived in a …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.