As Deutsche Bank AG hurries to rearrange the deckchairs in its boardroom, the firm is losing market share in some of its most important investment banking divisions. If something doesn’t change soon, there won’t be much of a business left for its new directors to oversee. In international bond underwriting, the largest fixed-income category for which Bloomberg compiles league tables, ...

Read More »Opinion

Macron’s battle to get France back on track

French President Emmanuel Macron’s fight with public-sector rail workers will show how serious he is about economic reform. Unions are promising two days of disruption each week unless the president abandons his plan to expose the network to a whiff of economic reality. Macron should stand his ground. A government-commissioned report published in February showed just how badly France’s rail ...

Read More »What the world’s markets can expect next from China

Trade tensions between the US and China have escalated to the point where each side has slapped tariffs on imports. The logical question is: What now? Although a deal between the two countries will be reached by the end of May, China is expected to announce policies that attempt to mitigate any economic downside resulting from the trade frictions. Those ...

Read More »Something is lost when companies stay private

The corporation is a societal construct; we give limited liability and other rights to the corporate form, but we expect something of corporations too. Private markets are the new public markets. That’s a thing that I say a lot, but here is a front-page The Wall Street Journal article about it: “At least $2.4 trillion was raised privately in the ...

Read More »Our robot overlords might be delayed

Are you stressed out about the singularity? Living in fear of the day when computers decide that humans are no longer necessary? Not to worry, say some leading experts in artificial intelligence: Research in the field might have actually hit a wall. No doubt, AI is everywhere. Computers assess financial news, identify viruses and even act as physics theorists, analyzing ...

Read More »Facebook’s present is as scary as its checkered past

The fresh disclosures about the Cambridge Analytica affair are dismaying for Facebook Inc., and they were getting a lot of deserved attention last week. But what happened at the shadowy political consulting firm is largely about Facebook’s past. The company made other changes that highlighted how lax it is currently being in allowing access to information from the social network’s ...

Read More »Rational markets theory keeps running into irrational humans

To many young people, the idea of efficient financial markets — the idea that, in the words of economist Eugene Fama, “At any point in time, the actual price of a security will be a good estimate of its intrinsic value†— probably seems like a joke. The financial crisis of 2008, the bursting of the housing bubble, and gyrations ...

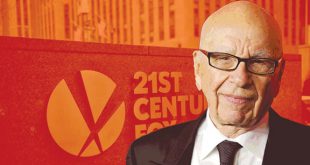

Read More »Murdoch gears up to fight for Sky

Investors betting that Rupert Murdoch’s Twenty-First Century Fox Inc. is ready to raise its 11.7 billion-pound ($16.4 billion) offer for Sky Plc have had their convictions reinforced. The media tycoon’s US television group has devised a cunning remedy to assuage British trustbusters’ concerns about the deal. It’s also sounding increasingly exasperated with the process. These are signs that Fox is ...

Read More »The UK finance gender pay gap isn’t bad. It’s worse

It’s probably worse than it looks. Government-mandated gender pay gap reports are rolling in before Thursday’s deadline. The inequality is stark for UK finance companies — data last month from Goldman Sachs Group Inc. showed a median gender pay gap of 36.4 percent — in other words, women earn 64 pence for every pound that men earn. While the median ...

Read More »Trade tensions already weigh on metal prices

The prices of industrial metals, oil and other commodities have risen significantly since the Chinese manufacturing recession ended in June 2016. But many have fallen from their highs in January 2018, first in reaction to the risk of higher interest rates and now, more critically, because of trade tensions and the potential for global manufacturing and growth to be slower ...

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.