Dubai / WAM Emirates Islamic announced the successful completion of a $200 million syndicated Murabaha term financing for Ajman Bank PJSC. Al Hilal Bank, Dubai Islamic Bank and Sharjah Islamic Bank joined the transaction as Initial Mandated Lead Arrangers & Bookrunners alongside Emirates Islamic. Emirates Islamic played a key role in coordinating the financing which carries a two year tenor. ...

Read More »News

Ajman-IBM deal to help spur emirate’s digital transformation

AJMAN / WAM Digital Ajman Government signed a joint cooperation agreement with IBM, on the sidelines of its participation at GITEX Technology Week 2017. The agreement will see IBM providing consulting and strategic planning services and determining both the processes and the technology requirements for Ajman’s Digital Government implementations. The agreement also aims to strengthen cooperation and coordination in the ...

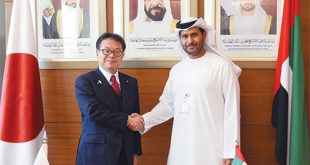

Read More »Abu Dhabi, Japan discuss ways to boost economic, investment ties

ABU DHABI / WAM Saif Mohammed Al Hajeri, Chairman of Abu Dhabi’s Department of Economic Development (ADDED), and Hiroshige Seko, Japanese Minister of Economy, Trade and Industry, have discussed means to reinforce economic and investment cooperation between Abu Dhabi and Japan. During a meeting, the two sides discussed mutual cooperation in the investment field and the industrial sector by addressing ...

Read More »Online registrations for VAT open

Abu Dhabi / WAM The UAE Federal Tax Authority (FTA), announced that online registration for Value Added Tax (VAT), is now open, through its website, as part of the Authority’s preparations for the 5 percent VAT, set to be introduced from January 1, 2018. This is part of the Authority’s commitment to facilitate the registration procedures for all businesses in ...

Read More »Abu Dhabi Air Expo to take place in Feb 2018

Abu Dhabi / Emirates Business Al Bateen Executive Airport, the first dedicated business aviation airport in the region, officially launched on Monday the fifth edition of Abu Dhabi Air Expo in response to huge demand from key industry professionals to participate. Abu Dhabi Air Expo 2018 will be held from February 26-28 2018, as part of Abu Dhabi Aviation and ...

Read More »MidEast Watch and Jewellery Show attracts over 60,000 visitors

Sharjah / WAM The Expo Centre Sharjah on Monday announced the success of the MidEast Watch and Jewellery Show, which attracted 61,456 visitors for its 43rd edition. The exhibition concluded on October 7 at the centre, having enjoyed notable local and international participation. Expo Centre Sharjah confirmed that the exhibition, which was held with the support of the Sharjah Chamber ...

Read More »UAE to mark ‘international day for disaster reduction’

Abu Dhabi / WAM The United Arab Emirates is participating in the International Day for Disaster Reduction, which falls on October 13 each year, under the slogan ‘Home Safe Home.†The aim of the event is to strengthen the global culture of disaster prevention and to deal with the situation and its consequences efficiently. In his statement to the Emirates ...

Read More »Dubai Culture’s new book to boost Islamic culture, art economy

Dubai / Emirates Business Dubai Culture & Arts Authority (Dubai Culture), the Emirate’s dedicated entity for culture, arts and heritage, has on Monday launched its ‘Global Perspectives on the Islamic Creative Economy’ book, featuring interviews that present the opinions of experts from local and international experts about how to consolidate Dubai’s position as an international centre for the Islamic Culture ...

Read More »MoF unveils ‘eCloud’ for financial, HR systems of federal entities

DUBAI / WAM The Ministry of Finance (MoF), launched its new eCloud service technology for the financial and human resources (HR), systems of federal entities, in collaboration with the Federal Authority of Human Resources (FAHR), and Oracle International, during its participation in GITEX Technology Week 2017. The new technology will provide a secure IT infrastructure with minimal intervention from operators ...

Read More »DIFC launches official mobile app

DUBAI / WAM Dubai International Financial Centre (DIFC), on Monday marked its first participation in the annual GITEX Technology Week, in collaboration with Smart Dubai. DIFC inaugurated its participation with the launch of ‘DIFC Connect’, the official Mobile App for DIFC which aims to offer an interactive platform that enhances the residents and visitors’ experience around the centre. Alya Al ...

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.