BLOOMBERG U.S. gasoline consumption is set to climb to a record this summer as the lowest pump prices in more than a decade encourage Americans to take to the roads. Demand, which typically peaks between the Memorial Day holiday in late May and Labor Day in early September, will average a record 9.5 million barrels during the second and …

Read More »International News

South Korea to raise $9.5bn funds to restructure shipyards

Seoul / Bloomberg South Korea will bolster capital at policy banks through a fund to support restructuring of the nation’s shipping and shipbuilding industries, the government said on Wednesday. The plan is for the government and the Bank of Korea to create an 11 trillion won fund ($9.5 billion) to make sure state lenders can withstand losses as they …

Read More »Prosecutors raid Daewoo Shipbuilding in fraud probe

Seoul / AFP Prosecutors on Wednesday raided Daewoo Shipbuilding and Marine Engineering Co., one of South Korea’s three giant shipbuilders, as part of a probe into a $2 billion accounting fraud. Some 150 staff from the Supreme Prosecutors’ Office stormed DSME headquarters in Seoul and its Okpo shipyard on the southern island of Geoje, the company said. “This morning, …

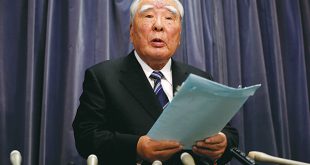

Read More »Suzuki plans resignations, pay cuts

Tokyo / Bloomberg Suzuki Motor Corp. Chairman Osamu Suzuki ceded the role of chief executive officer and one of his top deputies will resign after the automaker admitted to using unapproved fuel-economy testing methods in Japan. The 86-year-old Suzuki will decline the position of CEO and Executive Vice President Osamu Honda, 66, will step down as of the company’s …

Read More »Monsoon brings rain relief to drought-hit farms

New Delhi / Bloomberg India’s monsoon has finally arrived. The annual rains reached the southern state of Kerala on Wednesday, Sunitha Devi, an official with the India Meteorological Department, said by phone from Pune. The normal onset date for the monsoon is June 1 and the agency had said Tuesday that it would probably cover Kerala by June 9. …

Read More »Japan revises up Q1 growth

Tokyo / AFP Japan’s economy expanded at a slightly faster pace than first thought, revised figures showed on Wednesday, knocking hopes that the central bank will unleash fresh stimulus this month. The data were unlikely to inspire renewed faith in Prime Minister’s Shinzo Abe’s faltering growth policies, after Tokyo last week said it would delay a tax hike to …

Read More »ECB’s Draghi fires starting gun on corporate bond purchases in Europe

Bloomberg The European Central Bank started buying corporate bonds on Wednesday, according to people familiar with the matter. Purchases included €3 million ($3.4 million) of bonds sold by French utility Engie SA, along with 10-year notes from Telefonica SA, Spain’s biggest telecommunications company, and securities sold by Assicurazioni Generali SpA, Italy’s biggest insurer, said the people, who aren’t authorized …

Read More »French business confidence drops to 14-month low

Bloomberg French business confidence fell its lowest level in more than a year in May as strikes hampered refinery output and limited petrochemical supplies. A gauge of sentiment among manufacturing executives dropped to 97 in May, its lowest since March 2015 and down from 99 in April. The central cut its Q2 growth forecast to 0.2% from 0.3%. Workers at …

Read More »Danske tells clients to hedge for FX losses ahead of Brexit

Bloomberg Denmark’s biggest bank is telling clients to hedge against currency losses that will affect more markets than just the pound as Britain’s June 23 referendum on its European Union membership draws closer. Clients of Copenhagen-based Danske Bank A/S are being advised to hedge for a weaker pound against the euro and a weaker euro against the dollar and …

Read More »Rosneft Q1 profit falls 75% as crude oil slumps to low

Bloomberg Rosneft OJSC, Russia’s largest oil producer, said profit slumped 75 percent in the first quarter as crude prices hit their lowest point in over a decade. Net income dropped to 14 billion rubles in the first three months of the year compared to 56 billion rubles in the same period a year earlier, according to a statement on …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.