DUBAI / WAM

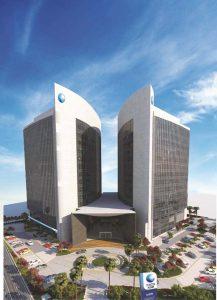

Abu Dhabi Islamic Bank (Adib) has achieved an upgrade to its environmental, social, and governance (ESG) risk score by Sustainalytics, one of the world’s leading ESG rating agencies.

Adib’s overall Sustainalytics ESG risk score has improved from 34.25 in 2022 to 29.6 in 2023, reflecting a significant leap that transitioned Adib from the ‘high risk’ category to the ‘medium risk’ category. This achievement underscores the bank’s commitment to ESG principles and ongoing efforts to effectively manage risks. The ratings are measured on a scale from 0 to 100, with lower scores indicating a risk reduction.

Lamia Khaled Hariz, Head of Corporate Communications, Marketing and Investor Relations at Adib, said, “Our priority lies in focusing on ESG aspects that create the greatest value by implementing product innovation with a clear focus on positive sustainability impacts. Over the past year, we have witnessed remarkable progress in terms of our ‘plan for a sustainable future’. However, there is still much work ahead of us, beginning with implementing our three-year standalone ESG Strategy.â€

By integrating ESG risk assessments, introducing green and social products, and leveraging the convergence of ESG and Shari’a principles, the bank further strengthens its efforts to lead the market towards sustainable financing. With a strong focus on creating wider positive impacts, Adib upholds ethical Shari’a principles and offers innovative products and services that promote affordability and sustainability for customers across the UAE and beyond.

During 2022, the bank took action to reduce its carbon footprint, recording a 26% reduction in energy intensity and allocating $1.7 billion to finance sustainable projects under green financing.

In addition, the bank obtained six green building certifications and succeeded in reducing its paper consumption by the equivalent of five million sheets through the “Al Ghaf Programme†to reduce paper consumption in the year 2022.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.