Bloomberg

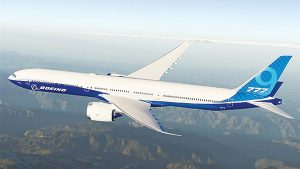

Boeing Co said customers for its much delayed 777X jet are standing by orders for the wide-body model even after it was revealed that the program has slipped five years behind schedule.

While Boeing has held talks to update buyers, feedback so far has stopped short of moves to walk away from the 777X, Darren Hulst, the manufacturer’s vice president for commercial marketing, said.

“Each one of our discussions with customers, obviously, is between us, but I haven’t heard of any specific desire to cancel,†Hulst said. That’s partly because many customers are buying the 777X in preparation for fleet-renewal programs that will become more pressing later in the decade, he said.

Hulst, speaking after some jet lessors suggested the 777X’s future is in doubt after Boeing last month postponed deliveries to 2025, said the plane remains the best fit at the top end of the wide-body segment, competing with the Airbus SE A350, as the 747 and A380 jumbos end production.

“I don’t think it has a peer in terms of the size, in terms of the payload it can carry, and it’s going to be a perfect replacement for airplanes as big as the A380,†he said on the fringes of the Airline Economics Growth Frontiers conference in Dublin.

Air Lease Corp Chairman Steven Udvar-Hazy said that issues with Boeing widebodies, including a production halt afflicting the smaller 787 Dreamliner, have become a major annoyance.

He said Boeing could even review the case for the 777X, should there be boardroom changes over the next two years. Air Lease Chief Executive Officer John Plueger said that after the latest delay the firm was contacted by two top airlines, both 777X customers or likely customers, about taking Airbus A350s. Hulst wouldn’t specify when he expects the 777X to finally take to the skies, saying “it’s obviously up to the regulator.â€

The executive said that Boeing remains confident in the strength of the post-pandemic rebound in travel demand, even as airlines and their passengers contend with the impact of surging oil prices and other costs.

While the recovery has been strong in the US, Europe and parts of Latin America, based on the size of the global economy “there’s still tremendous way to go in catching up to where the market normally would be,†he said. Major US airlines have already placed some large orders with Boeing, and the 737 Max narrowbody is selling well

after returning from being grounded, Hulst said.

Widebody interest is also returning following a slower recovery of long-haul travel.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.