Edinburgh/Munich / DPA Dolly is looking a bit bemused at the visitors arriving these days at the Royal Museum in Edinburgh. It was 20 years ago – February 23, 1997 – that reports surfaced about the birth of an extremely exceptional lamb. Dolly – named after the country and western singer Dolly Parton – is now a stuffed specimen, …

Read More »UAE initiatives vital for Yemen’s development

ABU DHABI / WAM The UAE’s initiatives in Yemen are making a difference in the country’s development and reconstruction, and have enabled fast-paced improvement in the humanitarian situation in areas liberated from the rebels, said Fahad Saeed Al Menhali, Yemeni Ambassador to the UAE. “By all measures, the response of the Emirates Red Crescent (ERC) to the humanitarian situation …

Read More »Dubai Customs attends Cargo and Personnel Screening conference

DUBAI / Emirates Business The Cargo and Personnel Screening Conference concluded in Dubai with recommendations from participants to give more focus on better cooperation between customs administrations and more technology to be involved in the screening process. The event was held at the Dusit Thani hotel in Dubai, and was organized by International Quality & Productivity Center (IQPC) in …

Read More »Africa Finance Corp carries out $150mn Nasdaq Dubai sukuk deal

DUBAI / WAM Africa Finance Corporation (AFC) has carried out a 150 million US dollar Islamic financing transaction on the Murabaha platform of Nasdaq Dubai, the international financial exchange serving the Middle East and Africa. The transaction was executed to facilitate the issuance by AFC of a 150 million US dollar Sukuk, which was the first US dollar Sukuk …

Read More »Musanada details progress of Emirati District project

ABU DHABI / WAM Abu Dhabi General Services Company Musanada announced the progress of infrastructure works of the Emirati District project in Madinat Zayed – Abu Dhabi within blocks 3, 4 and A2 according to the set plan. Suwaidan Rashed Al Dhaheri, Acting Chief Executive Official in Abu Dhabi General Services Company “Musanada†stated that the Emirati District’s infrastructure …

Read More »Crude curbs achieve 86% compliance

VIENNA / WAM OPEC and Non-OPEC countries are on target towards full conformity with their adjustments in oil production, revealed the Joint OPEC-Non-OPEC Ministerial Monitoring Committee (JMMC), according to a report by the Joint OPEC-Non-OPEC Technical Committee (JTC). ‘‘OPEC and Non-OPEC producers achieved a conformity level of 86 percent,’’ the JTC said. The JTC, a technical sub-committee of the …

Read More »New facilities launched for SMEs

DUBAI / Emirates Business Dubai Wholesale City, a global integrated wholesale trading hub and member of TECOM Group, has announced the launch of light industrial units and refrigerated warehouses at Dubai Industrial Park, the dedicated industrial hub within Dubai Wholesale City, at Gulfood 2017. In line with its participation at the premier global annual food expo, at the Dubai …

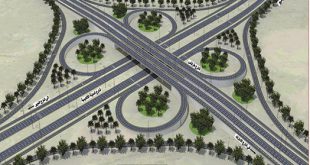

Read More »Mohammed approves AED1bn for improvement of Dubai roads

Dubai /Â WAM His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE, and Ruler of Dubai, approved the award of a contract for the improvement of Tripoli Road in a 12 km stretch to provide a link between the Sheikh Mohammed bin Zayed Road and the Emirates Road at a cost of AED500 million. …

Read More »DMCA to showcase innovative, advanced maritime services

Dubai / WAM Dubai Maritime City Authority (DMCA), the government authority charged with regulating, coordinating and supervising all aspects of the emirate’s maritime sector, will be presenting an integrated portfolio of the maritime licensing services at the Dubai International Boat Show 2017. The event will kick off on February 28 and will run till March 4 at the Dubai International …

Read More »UAE opens visa issuance centre at embassy in Tunisia

Tunis /Â WAM A visa-issuance centre for the UAE Embassy in the Tunisian capital was inaugurated by Ambassador of the UAE to Tunisia Salim Eisa Al Qatam Al Zaabi. The UAE, led by President His Highness Sheikh Khalifa bin Zayed Al Nahyan, has a keen interest in promoting and enhancing bilateral relations between the two countries, the ambassador said in …

Read More » The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.