Washington /Â AFP The Pentagon acknowledged for the first time that it has deployed US troops to Yemen since the country’s collapse last year to bolster government and Arab coalition forces battling Al-Qaeda. Spokesman Navy Captain Jeff Davis said the US military has also stepped up air strikes against fighters with Yemen-based Al-Qaeda in the Arabian Peninsula (AQAP). A “very …

Read More »TimeLine Layout

May, 2016

-

7 May

Israel aircraft hit Gaza as violence flares for 4th day

Gaza City /Â AFP Israeli aircraft hit two Hamas targets in Gaza early on Saturday in response to rocket fire as the worst flare-up of violence since a 2014 war entered a fourth day. There was no immediate claim of responsibility for the rocket launch and most such fire since 2014 has been carried out by fringe extremist groups but …

Read More » -

7 May

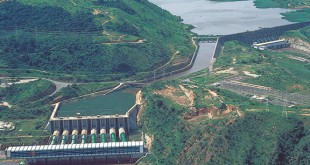

DRC to build $100bn hydropower plant

d r congo / Bloomberg The Democratic Republic of Congo said the developer for the first phase of the $100 billion Grand Inga hydropower project will be selected by August for construction to start by June next year. Two of the three groups that answered Congo’s 2010 call for bids remain in the running, Bruno Kapandji, head of the …

Read More » -

7 May

The misadventures of Fannie and Freddie

Gigantic government’s complexity and opacity provide innumerable opportunities for opportunists to act unconstrained by clear law or effective supervision. Today’s example, involving the government’s expropriation of hundreds of billions of dollars, features three sets of unsympathetic actors — a grasping federal government, a few hedge funds nimble at exploiting the co-mingling of government and the private sector, and two anomalous …

Read More » -

7 May

Global fight against smoking will continue

The crackdown on smoking advertising is assuming a global trend. Many countries are moving gradually to tighten grip on smoking promotion to reduce tobacco-related deaths. The tobacco industry, which rakes in huge revenues and gives employment to lot many people, is lobbying hard to put brakes on an all-out war against tobacco even as governments move cautiously to address …

Read More » -

7 May

Hong Kong’s tax revenue decline has a silver lining

Cal Wong SPECIAL TO EMIRATES BUSINESS Amid the slowdown in the Hong Kong property market, Hong Kong’s overall tax revenue has fallen for the first time in six years. In total, the taxman collected HK$291.3 billion (US$37.5 billion), down HK$10.6 billion from the year before. Stamp duty takings on property transactions have plunged 16 percent in the 2015-16 fiscal …

Read More » -

7 May

Does Australia lack commitment to building up its cities?

On Tuesday night, the Australian federal government delivered its budget for the forthcoming Australian financial year (1 July 2016 – 20 June 2017). The budget contained no dramatic announcements or big concepts. With an election to be held on July 2, and current polls indicating an erosion of its favorability, the conservative coalition government felt an inability to propose …

Read More » -

7 May

Housing must be job no. 1 for London’s new mayor

The bookies and polls called it correctly. Londoners chose the son of Pakistani immigrants as their next mayor over the Eton-educated heir to a family fortune. Now it will be up to Mayor Sadiq Khan to fulfil his promise to address the greatest source of London’s growing inequality: the city’s housing crisis. London housing is both expensive and scarce. …

Read More » -

7 May

Machines will never put humans out of work

Leonid Bershidsky It is now widely accepted that technological advances, especially ones that make machines more like humans — such as robotization or artificial intelligence — are putting people out of work and will only destroy more jobs in the future. The wealth will accrue to those who own the machines, not to what’s known as the middle class …

Read More » -

7 May

Corruption, economic development and poverty alleviation

Asit K. Biswas / Augustin Boey SPECIAL TO EMIRATES BUSINESS Corruption has probably existed since the dawn of human civilization. With a steadily increasing population, accelerating economic activities accelerating, and intensification of global inequalities, corruption has become increasingly commonplace and pervasive. Alan Greenspan, former Chairman of the Federal Reserve of the United States of America, has observed: “Corruption, embezzlement …

Read More »

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.

The Gulf Time Newspaper One of the finest business newspapers in the UAE brought to you by our professional writers and editors.